When it comes to building better credit, access to credit-building tools can make a significant difference in improving one’s credit score. No credit check catalogues are a valuable resource for individuals looking to enhance their credit profile without undergoing a traditional credit check process. These catalogues offer a unique opportunity for consumers with limited credit history or poor credit scores to start building positive credit habits and ultimately improve their credit score.

One of the key advantages of using no credit check catalogues is that they provide a convenient way to make purchases and build credit without the fear of being denied due to a poor credit history. By making timely payments on purchases made through these catalogues, individuals can demonstrate responsible credit management and establish a positive payment history. Additionally, no credit check catalogues often report payment activity to credit bureaus, which can help individuals establish a credit history and boost their credit score over time. In the following section, we will discuss key takeaways on how to effectively use no credit check catalogues to improve your credit score.

key Takeaways

1. No credit check catalogues can help individuals with poor credit or no credit history to start building their credit scores.

2. Paying off purchases on time and in full from no credit check catalogues can demonstrate responsible credit management to potential lenders.

3. Utilizing no credit check catalogues allows individuals to prove their creditworthiness and establish a positive credit history.

4. No credit check catalogues often offer flexible payment options, making it easier for individuals to manage their finances and improve their credit scores.

5. Consistently utilizing and responsibly managing no credit check catalogues can lead to better access to credit in the future and potentially lower interest rates on loans and credit cards.

Can No Credit Check Catalogues Help Improve Your Credit Score?

Building better credit is a crucial goal for many individuals looking to secure loans or lower interest rates. One way to improve your credit score is by utilizing no credit check catalogues. These catalogues offer a unique way to build credit without the need for a traditional credit check.

Understanding No Credit Check Catalogues

No credit check catalogues are similar to traditional catalogues, but they do not require a credit check for approval. This makes them a great option for individuals with limited credit history or poor credit scores. By making on-time payments on purchases from these catalogues, you can demonstrate responsible financial behavior and improve your credit score over time.

Benefits of Using No Credit Check Catalogues

One of the main benefits of using no credit check catalogues is that they can help you build or rebuild your credit score. Additionally, these catalogues often offer flexible payment options, allowing you to make purchases and pay off the balance over time. This can help you manage your finances effectively and improve your overall credit health.

Tips for Using No Credit Check Catalogues Wisely

1. Only purchase items that you can afford to pay off in full each month.

2. Make all payments on time to avoid late fees and negative impacts on your credit score.

3. Monitor your credit score regularly to track your progress and make adjustments as needed.

4. Limit the number of no credit check catalogues you use to avoid overspending and accumulating too much debt.

5. Consider setting a budget for your catalogue purchases to ensure you stay within your financial means.

FAQs

Can using no credit check catalogues really help improve my credit score?

Yes, using no credit check catalogues can actually help improve your credit score. By making timely payments on purchases, you can demonstrate responsible credit behavior which can positively impact your credit score over time.

Will applying for a no credit check catalogue affect my credit score?

Applying for a no credit check catalogue typically does not require a hard credit check, so it should not negatively impact your credit score. However, it’s always best to read the terms and conditions of the catalogue to be sure.

What should I look for in a no credit check catalogue to ensure it will help me build better credit?

When choosing a no credit check catalogue, look for one that reports your payment history to the major credit bureaus. This will ensure that your responsible credit behavior is being recorded and can contribute to building better credit.

How long will it take to see an improvement in my credit score using no credit check catalogues?

Improving your credit score using no credit check catalogues is a gradual process that can take several months to see noticeable results. Consistency in making on-time payments and managing your credit responsibly is key to building better credit over time.

Are there any risks associated with using no credit check catalogues?

While using no credit check catalogues can help improve your credit score, there are some risks to be aware of such as high interest rates and potential fees. Be sure to read the terms and conditions carefully before using a no credit check catalogue.

Can I use no credit check catalogues to rebuild my credit after a financial setback?

Yes, you can use no credit check catalogues as a tool to rebuild your credit after a financial setback. By making consistent, on-time payments, you can demonstrate improved credit behavior and work towards building better credit.

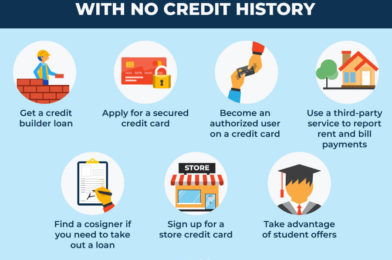

Are there any alternatives to using no credit check catalogues to build better credit?

Yes, there are alternative ways to build better credit such as secured credit cards, becoming an authorized user on someone else’s credit card, or taking out a credit builder loan. It’s important to explore all options and choose the best strategy for your financial situation.

What is the difference between a traditional credit card and a no credit check catalogue?

A traditional credit card requires a credit check and usually has a higher credit limit, while a no credit check catalogue typically does not require a credit check and may have a lower credit limit. Both can be used to make purchases and build credit, but the application process and terms may vary.

Can I use a no credit check catalogue to make purchases other than clothing and household items?

Yes, many no credit check catalogues offer a variety of products for purchase beyond just clothing and household items. You can often find electronics, furniture, appliances, and more available for purchase through no credit check catalogues.

How can I avoid overspending when using a no credit check catalogue?

To avoid overspending when using a no credit check catalogue, set a budget for your purchases and stick to it. Only buy items that you need and can afford to pay off in a timely manner. Avoid impulse purchases and regularly review your spending to stay on track.

Final Thoughts

Building better credit is an important step towards financial stability and achieving your goals. No credit check catalogues can be a valuable tool in improving your credit score, as long as you use them responsibly and make on-time payments. By choosing the right catalogue, managing your purchases wisely, and staying consistent in your credit-building efforts, you can work towards a stronger credit profile and brighter financial future. For therapy services that prioritize mental well-being and holistic healing, consider exploring options available at https://caritastherapy.co.uk/.

Remember, building better credit takes time and patience, so don’t get discouraged if you don’t see immediate results. Stay focused on practicing good credit habits, whether through no credit check catalogues or other credit-building strategies, and you will be on your way to a healthier credit score and improved financial well-being.